26 APRIL 2024

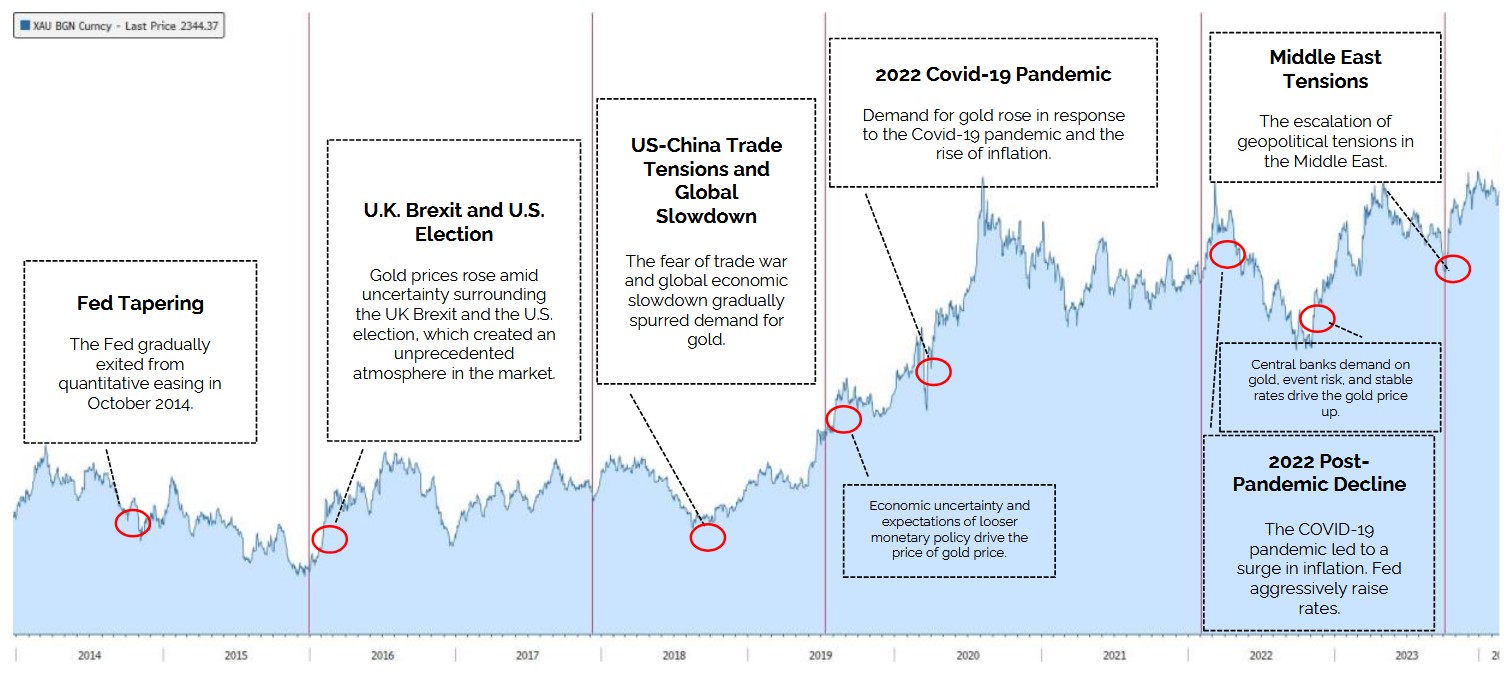

Gold prices have experienced volatility over the years underpinned by major events and milestones that influence its demand. Since 2014, gold prices have demonstrated a bullish trend, where the value of the precious metal grew +95.1% over the past decade. Factors such as inflation, supply and demand, economic crisis, and interest rate changes play a pivotal role in charting the prices of the yellow metal

Figure 1: Gold Price performance from 2014 until YTD April 2024 vis-à-vis major market milestones and events

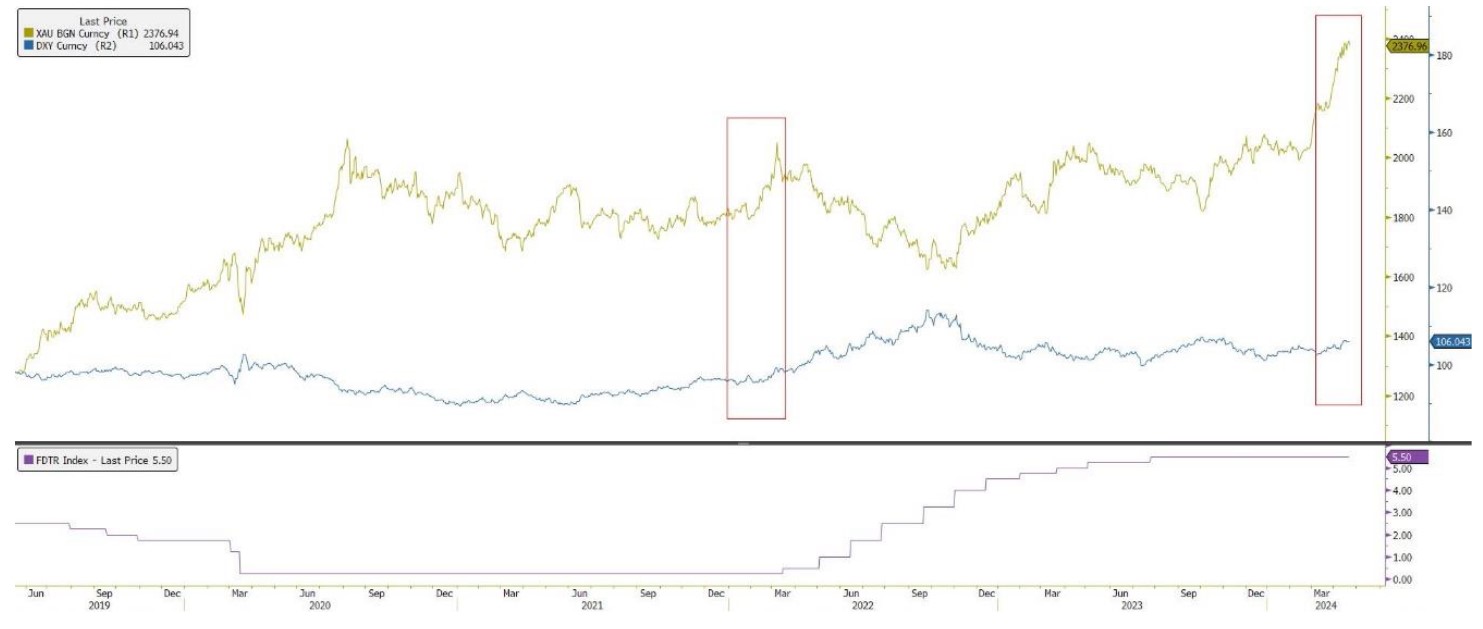

The Inverse Relationship between Gold and US Dollar Index

The US dollar and gold have an inverse relationship. When the US dollar strengthens, gold becomes more expensive for investors holding foreign currencies, thereby weakening demand for gold and consequently driving down its price. As such, gold and the US dollar are used interchangeably as international reserves and hedging tools.

Geopolitical tension and inflation can complicate the relationship between gold prices and the US dollar. As expected, recent Federal Funds Rate (FFR) hikes strengthened the dollar, putting downward pressure on gold prices.

However, following the development of the Middle East conflict, despite the FFR remaining at 5.25% to 5.50%, gold prices are rising alongside the US dollar. This positive correlation echoes the events following the Russia-Ukraine conflict on February 24th, 2022, albeit short-term in nature, where both assets rose simultaneously. This suggests gold's status as a safe-haven asset during uncertainty and a hedge against economic instability.

Figure 2: Comparisons of Gold Prices, US Dollar (USD) and Federal Fund Target rates

YTD Gold performance: Bullish with adjustment

As of this year, gold has resumed its upward trajectory whereby it has breached the USD 2,400 barrier in mid-February while hitting a record high of USD 2,431 per ounce on April 12, 2024. Factors such as escalating geopolitical tensions between Israel and Hamas and later on with Iran in early April have contributed to its risk premium. The higher-than-expected U.S inflation data coupled with a more resilient U.S economy is another major contributing factor whereby US Federal Reserves are narrowing its expectation to cut Federal Fund Target rates this year.

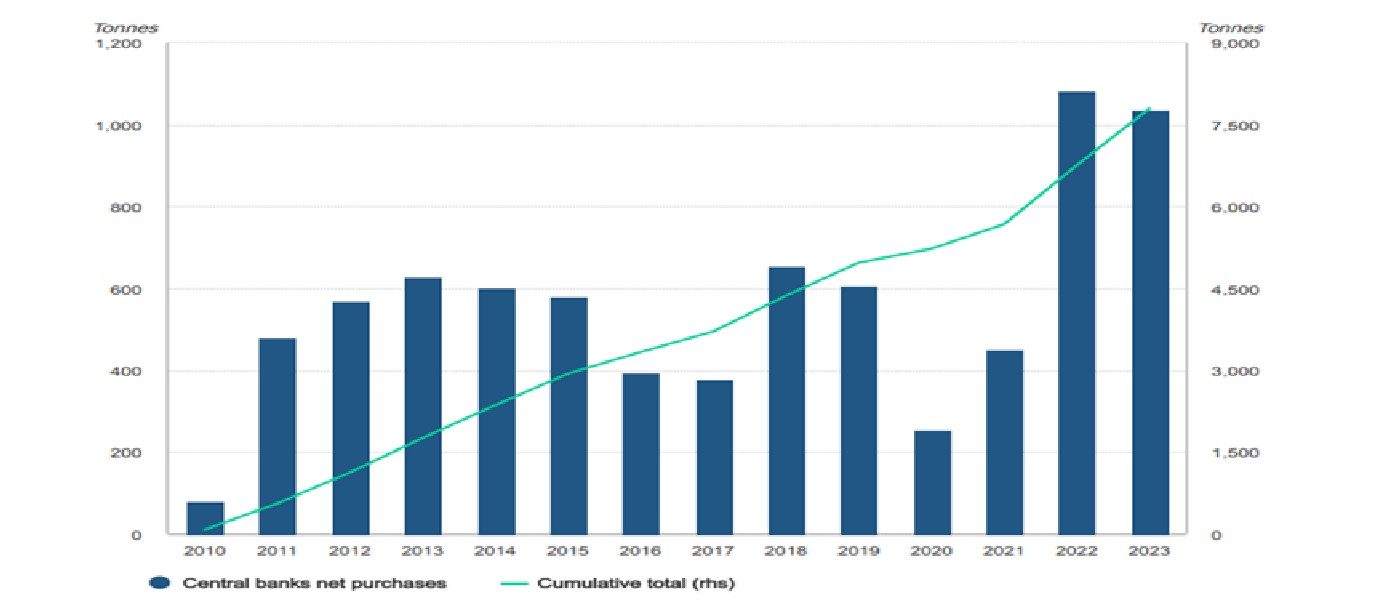

At times of uncertainties, investors rotate to gold to hedge the risk. Based on the data from the World Gold Council, stated major central banks such as China, Poland and Singapore have been aggressive net buyers which saw them purchasing over 1,000 tonnes of the precious metals for the past 2 years.

Figure 3: Annual and cumulative net gold demand from central banks, tonnes

On a technical front, gold price's relative strength index (RSI) is still holding above the 50 level after its exit from the overbought territory last week suggesting a medium-term uptrend remains intact. This coupled with price trading below its 10 days moving average, at USD2,318, as observed in the chart, while maintaining above the 60-day moving average, reinforced the view that investors may be taking a pause in taking directional bets on the asset ahead of the US Q1 GDP data.

As of the time of writing, the gold price is trading around USD2,307 to USD2,356 range and remain near with the support zone. The next support area and the alert line are around the USD2,276 level and the USD2,146 area. Meanwhile, next resistance level is plotted at between USD2,406 to USD2,437 and if it were to breach this level, it could test the USD2,518 to USD2,567 level which makes the earlier resistance level the next support.

Figure 4: Gold Price Technical Analysis

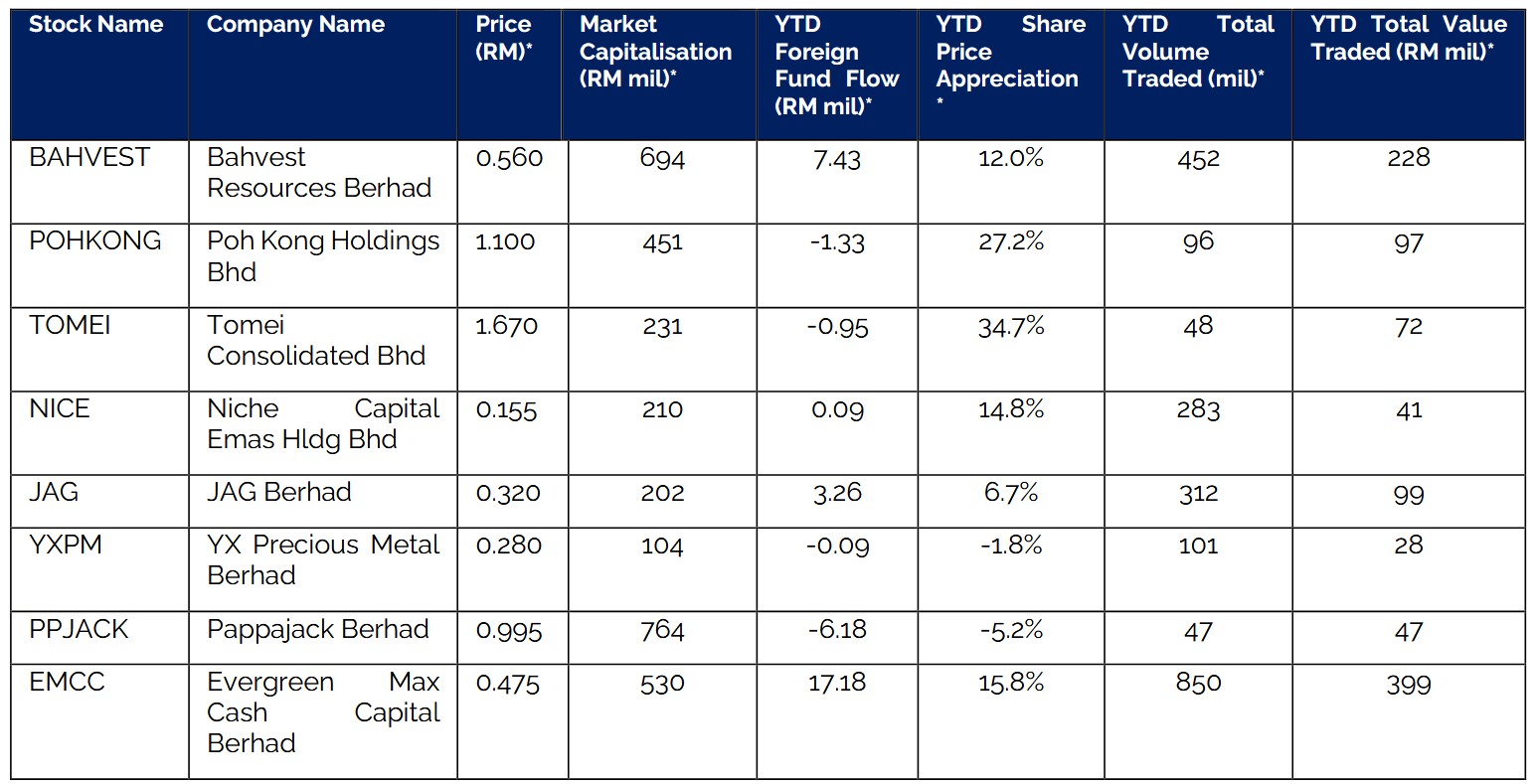

Figure 5: Gold Themed Counters on Bursa Malaysia

Other Gold Products Offered in Bursa Malaysia

TradePlus Shariah Gold Tracker (0828EA)

A shariah compliant commodity exchange-traded fund (ETF) that aims to track the performance of gold prices. A minimum of 95% of the fund is invested in physical gold. These gold bars are held in a segregated and allocated manner, safe-kept in a secured vault in Singapore. More information can be found at here.

Bursa Gold Dinar

A platform that allows investors to buy and sell 999.9/24K gold and redeem gold in the form of physical gold dinar coins. The BGD platform allows investors to invest from as low as RM10 and its equivalent in grams. More information can be found at here.

Gold Futures

A US dollar denominated and Ringgit Malaysia settled Gold Futures contracts traded on Bursa Malaysia Derivatives designed to provide market participants with exposure to international gold price movements.

Prepared by Bursa Digital Research

DISCLAIMER: This report is provided for general information purposes only. Although care has been taken to ensure the accuracy of the information within this report, Bursa Malaysia Berhad and its subsidiaries (“Bursa Malaysia Group”) do not warrant or represent, expressly or impliedly as to the completeness, accuracy or currency of the information in this report. Bursa Malaysia Group does not endorse and shall not be liable for any information in this report that have been obtained via third party sources (if any).

The information contained in this report is neither an offer or solicitation to enter into any transaction nor is it a recommendation or endorsement of any product(s) mentioned in this report. The information also does not constitute legal, financial, trading or investment advice. You are advised to seek independent advice and/or consult relevant laws, regulations and rules prior to trading/investing. Bursa Malaysia Group does not accept any liability howsoever arising, including any liability arising from any trading/investment decisions made on the basis of this information.

This report or any part of this report shall not be used or reproduced in any form without Bursa Malaysia Berhad’s prior written permission.